What $300K Can Actually Build You in Nova Scotia (And What It Earns Back)

If you're looking at investing $300,000 in Nova Scotia's rental market, you're likely wondering: can this build a fourplex, and will it generate solid returns? The short answer: yes, and it can deliver gross annual rental income of $91,200 to $108,000. Construction costs average $160,000 per unit - lower than the national average - and with programs like CMHC MLI Select offering 95% loan-to-value financing, your upfront costs stay manageable. This article breaks down what $300K can achieve, including construction timelines, financing structures, and the income potential across key areas like Halifax and Truro.

Construction Costs for Multi-Unit Rentals in Nova Scotia

Building multi-unit rental properties in Nova Scotia by 2026 follows a predictable cost structure, influenced by the chosen construction model and location. While typical multi-unit builds across Canada often exceed $200,000 per unit, using an integrated design-build approach can reduce costs to approximately $160,000 per unit - around 10% below CMHC benchmarks. Let’s break down how this fixed-price approach works and why it avoids unnecessary expenses.

Fixed-Price Construction at $160,000 Per Unit

For a $300,000 initial investment, the fixed-price model ensures each unit costs $160,000 to build. This pricing applies to various configurations: $640,000 for a fourplex, $960,000 for a sixplex, and $1,280,000 for an eightplex. To reinforce timelines, the model includes a $1,000-per-day penalty for delays beyond the guaranteed six-month completion period.

"I personally review every quote and guarantee every timeline", says Lloyd Liu, Co-Founder & CEO of Helio Urban Development [1].

This competitive pricing is achieved by cutting out unnecessary markups. Typically, property owners face extra costs when hiring separate architects, engineers, contractors, and project managers - layers of coordination that can inflate costs by 20–30%. Instead, the design-build approach consolidates these roles, avoiding inefficiencies. For example, in Truro, labour and material costs are about 15% lower than in Halifax. Even building permit fees highlight the disparity: a 4,000-square-foot fourplex costs roughly $240 in Truro (at $0.06 per square foot), compared to over $1,200 in Halifax [4].

Pre-designed layouts also speed up the process, eliminating months of custom drafting. Standardized designs ensure consistent material and labour requirements, keeping both timelines and budgets in check [2].

"Our AI scheduling system prevents the delays that killed our first project", notes Yuan He, Co-Founder & CTO [1].

Hard Costs vs. Soft Costs

Breaking down the $160,000 per unit price reveals where the money goes and helps clarify what’s included - and what’s not.

Hard costs, covering materials and labour, make up the bulk of the price. These include foundation work, framing, roofing, mechanical-electrical-plumbing (MEP) systems, and high-quality finishes like triple-pane windows, quartz countertops, and engineered hardwood flooring. Essential systems such as heat pumps, heat recovery ventilators (HRV), and hot water tanks are also part of the package.

Soft costs refer to non-construction expenses, which typically account for about 3% of the total project cost [3]. These include architectural and engineering fees, project management, and five inspections by a professional engineer (P.Eng). Additionally, site development - such as preparing the land for construction - adds roughly $15,000 per unit [3].

It’s important to note that fixed-price quotes don’t cover site-specific factors like land acquisition, demolition, utility connections, landscaping, or municipal development charges. These costs vary significantly depending on the location and specific project requirements.

sbb-itb-16b8a48

Building a Fourplex with $300K Down

With a $300,000 down payment, you can build a fourplex using CMHC MLI Select financing. At a fixed construction cost of $160,000 per unit, the total cost for a fourplex is approximately $640,000. Your down payment covers nearly half of the construction and site costs. The remaining $340,000 can be financed through CMHC MLI Select, which allows up to 95% loan-to-value financing for qualified, owner-occupied projects. This is a significant advantage compared to conventional financing, which often requires a larger down payment for non-owner-occupied properties. Let’s break down the costs, financing structure, and rental income potential.

Fourplex Cost Structure

The $640,000 construction cost includes hard costs such as the foundation, framing, roofing, mechanical systems, and high-end finishes. Adding site preparation costs ($60,000) and soft costs (about $21,000), the total cost before factoring in land comes to roughly $721,000. This means your $300,000 down payment covers about 42% of the project, giving you strong equity right from the start.

The remaining $340,000 financed through CMHC MLI Select results in monthly mortgage payments of $2,000 to $2,300, depending on current interest rates. On the income side, a fourplex with 2-bedroom units in areas like North End Halifax can generate rents of $1,900 to $2,250 per unit, leading to gross monthly rental income between $7,600 and $9,000. After accounting for typical operating expenses (around 25% of gross income), the net operating income should comfortably cover mortgage payments, leaving you with positive cash flow from the first year.

6-Month Construction Timeline

Helio commits to completing the project in six months - from permit approval to occupancy. To back this up, there’s a $1,000 per day penalty for delays beyond the agreed timeline. This streamlined process is made possible through pre-designed layouts and an integrated design-build approach, which eliminates many of the inefficiencies found in traditional construction.

During the six-month build, you’ll carry mortgage payments on the $340,000 loan, amounting to about $12,000 to $13,800 over that period. Once the property is ready and tenants move in, the rental income should cover these costs, allowing you to reach positive cash flow within 14 to 16 months of starting the project. This timeline ensures a quick turnaround, reducing the financial strain during the construction phase.

Financing Options for $300K Investments

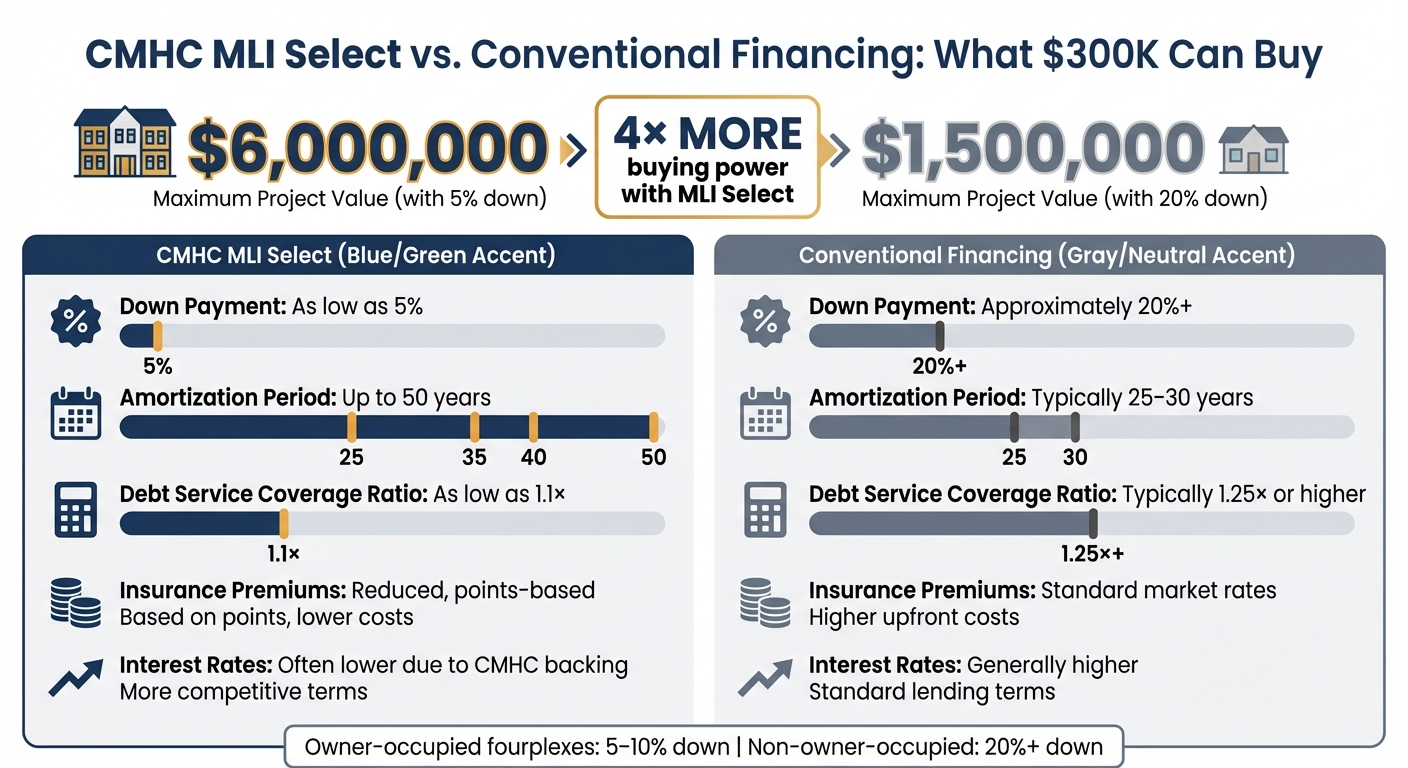

CMHC MLI Select vs Conventional Financing Comparison for $300K Investment

CMHC MLI Select Financing

The CMHC MLI Select program allows you to finance up to 95% of a multi-unit rental project, meaning your $300,000 down payment can control an asset worth significantly more. Unlike traditional commercial mortgages, which typically cap at 75–80% loan-to-value, MLI Select reduces your equity requirement to as little as 5% - provided your project meets criteria for affordability, energy efficiency, and accessibility.

With $300,000 down, MLI Select enables you to finance projects valued up to $6,000,000. By comparison, conventional financing, which usually requires a 20% down payment, would limit you to a project worth around $1,500,000.

The program also offers up to 50-year amortization periods, which can reduce your monthly payments and boost cash flow from the start. Insurance premiums under MLI Select are lower than those of standard CMHC products, and the program allows for a debt service coverage ratio as low as 1.1× - a notable improvement over the typical 1.25× required by conventional lenders. Helio's standard designs are already pre-qualified for MLI Select, meeting the energy efficiency standards (such as triple-pane windows and ductless heat pumps) needed to qualify for 95% financing.

This structure allows you to scale your investment far beyond what conventional financing would permit.

CMHC MLI Select vs. Conventional Financing

Here’s how MLI Select stacks up against traditional financing options, showing how it can make larger projects more accessible and improve affordability:

| Feature | CMHC MLI Select | Conventional Financing |

|---|---|---|

| Maximum Project Value (with $300K down) | Up to $6,000,000 (5% down) | Up to $1,500,000 (20% down) |

| Amortization Period | Up to 50 years | Typically 25–30 years |

| Down Payment Requirement | As low as 5% | Approximately 20%+ |

| Debt Service Coverage Ratio | As low as 1.1× | Typically 1.25× or higher |

| Insurance Premiums | Reduced, points-based | Standard market rates |

| Interest Rates | Often lower due to CMHC backing | Generally higher |

For owner-occupied fourplexes, down payments can range from 5–10%, while non-owner-occupied properties generally require at least 20%. This makes MLI Select an appealing choice for investors looking to maximize their purchasing power.

Rental Income and Return on Investment

Expected Rental Income

Building on the earlier cost and financing breakdown, let’s look at how rental income and returns stack up. For a fourplex with four 2-bedroom units, gross annual rental income ranges between $91,200 and $108,000. These numbers reflect the appeal of new-build properties, which tend to command higher rents. With local vacancy rates hovering around 2.1% and annual rent growth at 6.4%, these properties promise stable income and room for future increases.

Once this consistent rental income is established, we can shift focus to the investment’s cash-on-cash returns.

Cash-on-Cash ROI Calculation

Cash-on-cash ROI gauges how much annual cash return you’re getting compared to your total cash investment. Let’s break it down using a fourplex project costing $650,000 in total. Here, you’ve invested $300,000 to cover the down payment and soft costs, while the remaining $350,000 is financed.

If the four units generate a gross annual income of $100,000, and we apply a conservative operating expense ratio of 35% (covering property taxes, insurance, maintenance, and a vacancy allowance), the annual expenses would be around $35,000. This leaves a net operating income (NOI) of roughly $65,000.

With a mortgage of $350,000 at a 5% interest rate over 25 years, the annual financing cost comes to about $22,000. Subtracting this from the NOI results in a net cash flow of approximately $43,000 per year.

The cash-on-cash ROI is then calculated like this:

ROI = ($43,000 ÷ $300,000) × 100 ≈ 14%

This figure reflects your first-year cash return, excluding benefits like principal paydown, property appreciation, or tax advantages. Additionally, the shorter construction timeline means you can start generating rental income sooner.

Site Requirements and Project Risks

Land Ownership and Site Preparation

Getting your site ready is just as important as figuring out your construction budget. To qualify for CMHC MLI Select, you need to have full ownership and control of the land - no liens, no disputes, and it must be zoned properly for multi-family use.

Site preparation costs can vary widely. Clearing, grading, and excavation will set you back between $20,000 and $50,000. If you’re building in places like Halifax or New Glasgow, you’ll need to budget an extra $5,000 to $15,000 for soil testing and stormwater management to comply with local rules. Utility hookups are another expense, ranging from $15,000 to $30,000, which includes:

- Three-phase electrical: $8,000–$15,000

- Water/sewer connections: $5,000–$10,000

- Gas or propane lines: $2,000–$5,000

Altogether, these costs mean your $300,000 down payment has to cover both the builder’s deposit and these upfront site expenses. If you focus on vacant lots in urban areas - typically under 0.5 acres - you can keep your total site prep costs in the $35,000 to $80,000 range. This leaves more of your budget available for construction.

Once you’ve secured your site and accounted for these costs, the next step is tackling market risks.

Market Risks and How to Manage Them

Even with a well-prepared site, the market can throw unexpected challenges your way. While current fundamentals look strong - 2.1% vacancy rates and 6.4% rent growth - there are still risks to consider. For instance, rental demand isn’t always steady. In tighter markets like Halifax, a sudden increase in supply could lead to oversaturation. Meanwhile, areas with seasonal employment, such as Cape Breton or the North Shore, might see vacancy rates spike to 10–20% during slower months.

Rent caps can also be a hurdle. Many municipalities limit annual rent increases to 2–5%, so if your operating costs rise faster than that, your returns could take a hit. Make sure to confirm the local rent cap rules before you start planning rents.

Construction delays are another common issue. While Helio guarantees a 6-month build timeline and backs it with a $1,000/day late penalty, traditional projects can drag on for 9–12 months. Permitting alone can cause 2–3-month delays, and bad weather can push timelines even further, potentially adding $20,000 or more in soft costs. Rising interest rates during construction could also impact your numbers. For example, if rates climb, your cash-on-cash ROI might drop from 8–12% to 5–7%. To prepare, stress-test your pro forma with an 85% occupancy rate and a 2% annual rent cap.

Lastly, site-specific risks can significantly affect your budget. Geotechnical surveys are essential to identify any soil issues that could lead to unexpected costs. Double-check zoning setbacks with municipal planners early - getting this wrong might force you to cut your planned unit count, say from 8 units to 4, slashing your potential equity. To avoid delays, aim for sites near major employment hubs and those with existing utility access. This upfront diligence can save you a lot of headaches down the line.

Conclusion

Investing $300,000 in Nova Scotia can deliver a fourplex generating $4,800–$5,200 in monthly rent after a six-month build period. With fixed construction costs at $160,000 per unit and CMHC MLI Select financing offering 95% loan-to-value, your upfront costs are predictable and manageable.

The benefits go beyond cash flow. Income-based bank valuations at a 5% cap rate create immediate equity, significantly boosting your property’s value from the start. Add in HST rebates, and your effective investment cost drops even further. This combination of cash flow and equity creation makes this strategy a powerful way to grow your real estate portfolio.

Of course, risks like rent caps and potential construction delays exist. However, working with a design-build team that guarantees fixed pricing and timelines can help mitigate these challenges. Nova Scotia’s strong market fundamentals - low vacancy rates and steady demand from healthcare and education sectors - further bolster this investment case.

Whether you’re exploring Truro’s 15% lower construction costs or Dartmouth’s flexible ER-3 zoning, opportunities to build wealth are everywhere. The real question is: are you ready to take the next step?

FAQs

Does the $300,000 include the land cost?

No, the $300,000 typically excludes land costs. This amount is usually reserved for the construction and development of multi-unit rental properties within Nova Scotia.

What do I need to qualify for CMHC MLI Select at 95% LTV?

To be eligible for CMHC MLI Select with a 95% loan-to-value (LTV) ratio, you need a net worth equal to at least 25% of the loan amount, with a minimum requirement of $100,000. Additionally, you must meet the program's scoring criteria by earning at least 50 points, which can be achieved through a mix of affordability, energy efficiency, or accessibility features.

What happens if the build takes longer than 6 months?

If a construction project stretches beyond six months, it often triggers cost overruns, longer timelines, and delays in generating rental income. Expenses can climb by 30–60%, and every extra month of delay might mean losing around $8,800 in rental income. These issues can heavily affect your overall return on investment and push back the completion of your project.