Build vs. Buy: The Investor's Guide to Rental Property in Canada

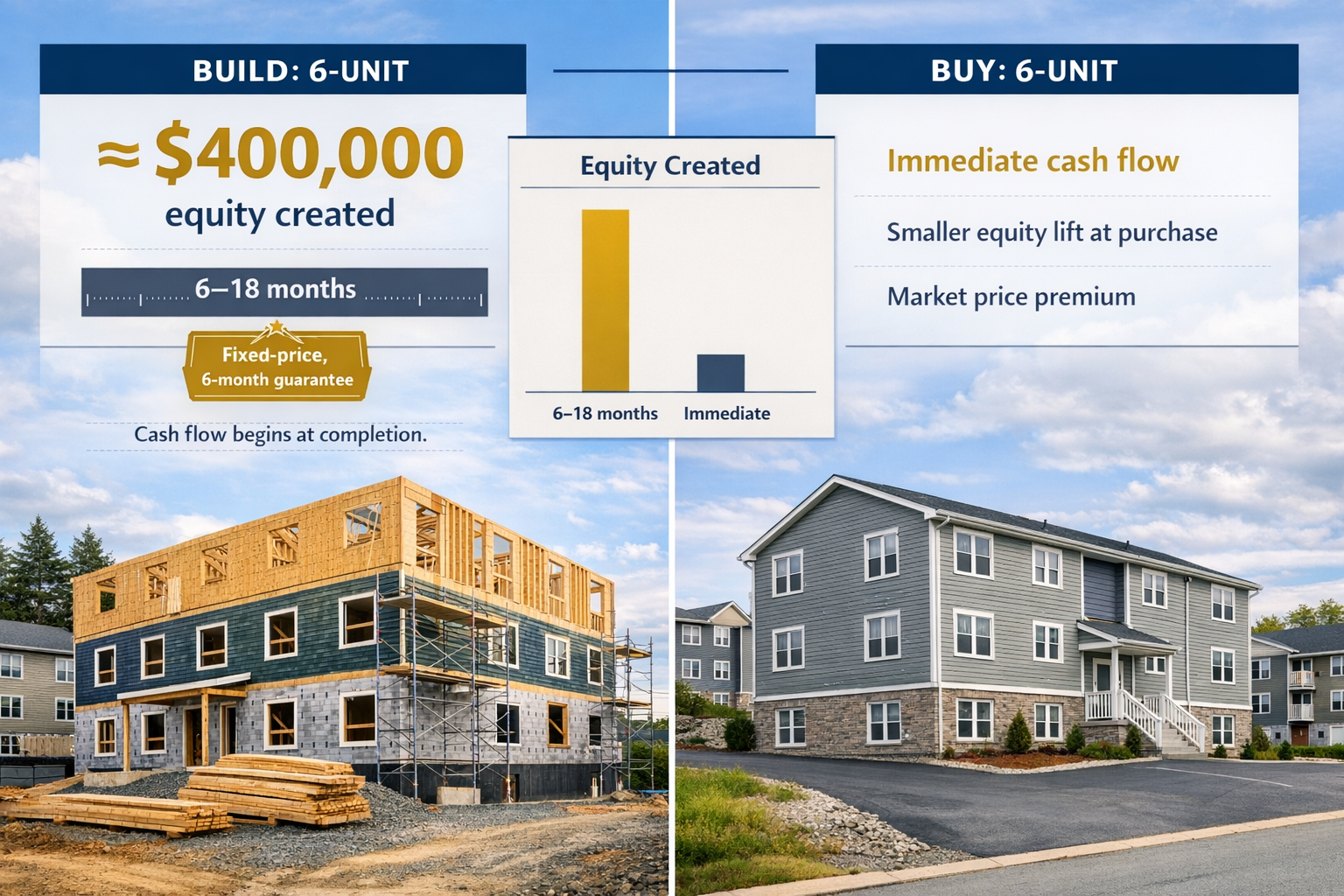

If you're considering rental property investment in Nova Scotia, you're likely weighing two options: buying an existing building or building new units from scratch. For example, a 6-unit building in Halifax might cost you $2.1M at market value, while constructing the same could run you $1.7M, leaving you with $400,000 in equity right after completion. But building means waiting 6–18 months before seeing rental income, while buying offers cash flow almost immediately.

This guide breaks down the numbers, timelines, and risks for both approaches, helping you decide which aligns with your financial goals. Whether you're eyeing Halifax, Truro, or Kentville, the right choice depends on your budget, patience, and appetite for risk. Let’s dig into the details so you can make an informed decision.

Building vs Buying Rental Property in Nova Scotia: Cost and Timeline Comparison

"Build-to-Rent" 101 and Why Building Makes You MORE Than Buying

sbb-itb-16b8a48

Financial Comparison: Building vs. Buying

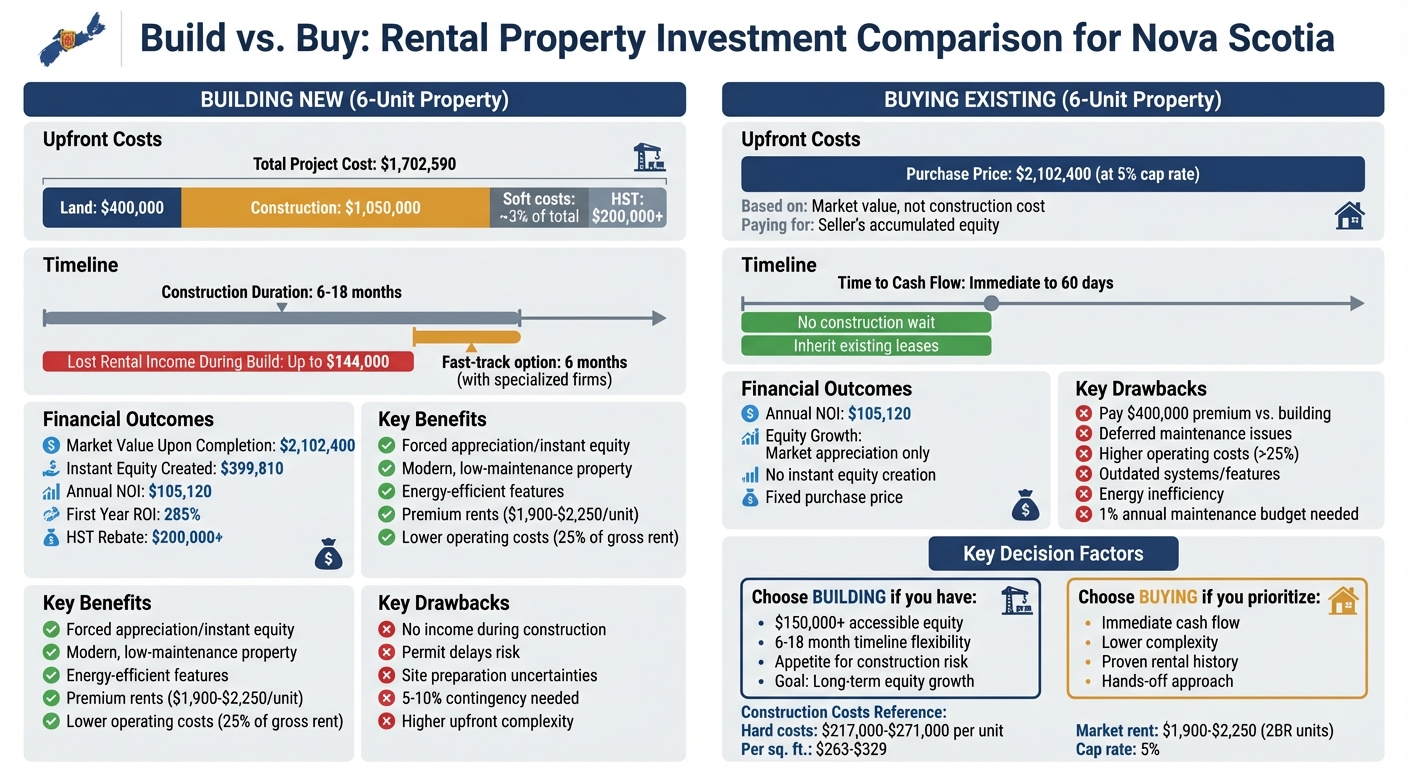

In Nova Scotia, purchasing a 6-unit building at market value costs approximately $2,102,400, based on a 5% cap rate. This would generate an annual net operating income of about $105,120 [1]. On the other hand, building the same 6-unit property from scratch involves a total project cost of roughly $1,702,590 - broken down as $400,000 for land and $1,050,000 for construction [1]. The difference creates an immediate equity gain of $399,810 upon completion, as lenders primarily assess the income potential of the property. However, these upfront cost differences lead to vastly different timelines and cash flow scenarios.

Building requires patience. Construction typically takes 6 to 18 months [1], during which you’ll be repaying a construction loan without generating rental income. This delay can result in up to $144,000 in lost rental revenue compared to buying an existing property [1]. Buying, by contrast, offers immediate cash flow since you can inherit existing leases or fill vacancies shortly after closing.

For a sixplex, hard construction costs in Atlantic Canada range from $1,297,000 to $1,621,000, or approximately $217,000–$271,000 per unit [4]. Adding soft costs like architectural, engineering, and legal fees (about 3% of the project total), HST (which can exceed $200,000 on a $1.5M project), and land acquisition, the upfront capital required becomes substantial [1]. While most construction loans demand a 20% down payment, CMHC MLI Select financing can reduce this to 5% for qualifying projects.

The risk profiles for building and buying differ significantly. Building comes with uncertainties like unexpected site issues, permit delays, and material cost fluctuations, necessitating a 5%–10% contingency [4]. Buying an existing property, however, carries risks such as deferred maintenance, outdated systems, or design limitations. As CMHC highlights:

"Market rents are rarely sufficient to cover the development and construction costs of projects" [3].

These risk differences should factor heavily into your decision-making process.

Ultimately, the choice comes down to your financial position and timeline flexibility. If you have enough equity and can handle a period without rental income, building offers the potential for forced equity creation and a modern, low-maintenance property. If immediate cash flow and a proven rental history are more critical, buying might be the better route - even if it means paying a premium and dealing with the upkeep of an older building. Balancing these financial and timing considerations is key before diving into Nova Scotia’s market data and making a decision.

Benefits of Buying Existing Rental Properties

Buying an existing six-unit building offers immediate cash flow, unlike new construction projects where you might wait 12–18 months to see your first rent cheque. In Nova Scotia, market rents for two-bedroom units typically range from $1,900 to $2,250 per month [2]. This steady income starts flowing from day one, providing financial stability that construction delays simply can't match.

Another advantage is avoiding the high carrying costs that come with new builds. In Nova Scotia, these costs can run up to $8,000 per month while you're waiting for permits and construction to finish [2]. That’s a significant burden you bypass entirely when purchasing a building that’s already operational.

You also dodge the risks tied to construction, such as unexpected bedrock issues, permit denials, or budget overruns that can inflate costs by as much as 30% due to rising material and labour expenses [2]. With an existing property, the purchase price is fixed, and the operating history is already established. This gives you reliable data for estimating expenses and vacancy rates. As CMHC points out:

"Market rents are rarely sufficient to cover the development and construction costs of projects" [3].

This challenge is avoided with older properties built under less expensive conditions.

Financing is another area where existing properties shine. Multi-unit buildings are valued based on their proven income, making financing more predictable. Lenders rely on cap rates and actual operating statements, which provide solid, bankable numbers. This is a stark contrast to speculative new builds, where uncertain pro forma projections might not support a 10% cash-on-cash return [3].

Finally, existing properties are ready to generate income almost immediately. You avoid delays caused by appliance installations or coordinating trades. Once you close, you inherit the current leases and can typically start collecting rent within 30 to 60 days. Compare that to waiting over a year for a new build to be completed. These practical advantages explain why many investors in Nova Scotia prioritize existing properties when immediate cash flow is their goal.

Drawbacks of Buying Existing Rental Properties

Buying existing rental properties might seem appealing due to the immediate cash flow they can offer, but this strategy comes with some notable downsides. One of the biggest issues is the price premium attached to these properties. In Halifax, for example, rental buildings are typically priced based on their income-generating potential rather than their construction costs. Essentially, when you buy an existing property, you're paying for the seller's accumulated equity. This often means a higher upfront cost, as you're inheriting the value they've built over time [1].

Older properties also come with maintenance headaches. Many have issues like poor fire separations, structural weaknesses, or outdated compliance with the National Building Code. These problems often only become apparent during inspections or renovations [5]. Systems such as HVAC, plumbing, and electrical are frequently outdated, requiring costly repairs and lacking the warranties or efficiencies that come with new builds. As Erica, a Research Analyst at Helio Urban Development, explains:

"A new build lets you tailor the design for high energy efficiency, modern amenities, and maximum rental income from Day One" [5].

Energy inefficiency is another challenge. Older buildings often lack features like triple-pane windows, ductless heat pumps, or high-grade insulation, which can lead to higher utility bills and lower appeal for tenants [2]. Operating expenses for these properties often exceed the benchmark of 25% of gross income seen in well-maintained new builds [1]. Additionally, you might need to budget around 1% of the property's value annually for ongoing repairs and maintenance [6].

Customization is yet another limitation. Modern tenants expect features like in-suite laundry, smart home tech (e.g., keyless entry), and upscale finishes like quartz countertops [2]. Without these, you may struggle to attract high-quality tenants or risk higher vacancy rates. This is especially problematic in the Halifax rental market, where vacancy rates hover around 1% [5]. Upgrading an older property to meet these standards can take as long as 18 months, during which you'll likely be covering mortgage costs without rental income - creating substantial opportunity costs [1][2].

Benefits of Building New Multi-Unit Rental Properties

Building new rental properties offers something existing buildings can't: instant equity creation. When you construct a multi-unit rental, its value is determined by income potential rather than construction costs. For instance, a project costing $1.7 million could be appraised at $2.1 million once completed and fully tenanted, instantly generating nearly $400,000 in equity [1]. This process, often called "forced appreciation", happens because lenders calculate value using Net Operating Income (NOI) and cap rates. In Nova Scotia, a newly built 6-unit rental can deliver a 285% return on initial investment within the first year when factoring in equity creation, cash flow, and tax rebates [1]. Beyond this equity boost, new builds come with clear financial and operational benefits.

From a financial perspective, the advantages are substantial. For example, HST rebates for a 6-unit project in Nova Scotia can exceed $200,000 [1]. Once the property is completed and tenanted, refinancing based on the new appraised value allows you to recover part of your initial down payment, freeing up capital for future projects [1][5]. Additionally, fixed-price construction contracts eliminate the 30% budget overruns that are common with fragmented development models, giving lenders the confidence to approve financing more easily [2][5].

Operationally, modern construction also reduces ongoing costs while commanding premium rents. Features like triple-pane windows, ductless heat pumps, HRV systems, and LED lighting significantly lower utility and maintenance expenses compared to older properties [2][5]. Tenants are often willing to pay higher rents for amenities such as in-suite laundry, quartz countertops, and smart home technologies like keyless entry and smart thermostats [2]. In Halifax, where the vacancy rate hovers around 1% and the average two-bedroom rent reached approximately $1,538 per month in 2023, these upgrades directly translate into higher cash flow [5].

Another major advantage is speed. Specialized design-build firms in Nova Scotia can deliver units in just 6 months, compared to the 18 months typical of traditional development methods. This faster timeline can save approximately $144,000 in lost rent for a 6-unit building [1]. As Lloyd Liu, Co-Founder & CEO of Helio Urban Development, puts it:

"I personally review every quote and guarantee every timeline" [2].

This quicker turnaround means you can start collecting rent and scaling your portfolio much faster than if you were buying existing properties that require extensive renovations or navigating slower construction timelines.

Drawbacks of Building New Multi-Unit Rental Properties

Constructing new rental properties comes with a set of challenges that aren't typically encountered when purchasing existing buildings. One of the most pressing issues is permit delays. These can stem from zoning setback miscalculations, inconsistencies between engineering and architectural plans, or the need for rezoning. Such delays can stretch timelines by months, with carrying costs adding up to approximately $8,000 per month for smaller multi-unit projects [2]. In rural areas of Nova Scotia, the situation can be even more complicated. Provincial road frontage requirements (usually 30 metres) and mandatory percolation tests for septic systems often add more time to the process [5]. As Yuan He, Co-Founder & CTO of Helio Urban Development, notes:

"Our AI scheduling system prevents the delays that killed our first project" [2].

These permitting hurdles often lead to unexpected site preparation costs.

Site preparation is another area where budgets frequently go off track. Clearing land, levelling it, and connecting utilities can vary widely in cost depending on the condition of the lot and the municipality's requirements. For instance, encountering bedrock or unstable soil can drive costs up by more than 30% [2]. On a well-prepared lot, site development for a 6-unit project might cost around $15,000 [1]. However, rural lots requiring wells and septic systems come with much higher costs and additional permitting requirements [5]. To avoid surprises, property owners should conduct a detailed feasibility study before purchasing land and maintain a contingency fund of 10–15% to cover unexpected issues [5].

Another significant challenge is the gap between market rent and the rent needed to achieve strong returns, which can make new builds financially unworkable in certain areas [3]. Adding to this, construction material costs can fluctuate during the project, although fixed-price contracts can help control this risk [2]. Cash flow is also affected by delays, as rent collection cannot begin until an Occupancy Certificate is issued [5].

Municipal standards add yet another layer of complexity. The permitting process varies significantly across Nova Scotia. For example, what might be approved without issue in Halifax could face additional obstacles in Truro or on the South Shore [5]. Including a purchase condition that ties the land sale to permit approval can safeguard your investment if zoning challenges arise [5].

Despite these obstacles, an integrated design-build approach can help reduce these risks. By working with a single company that handles planning, architecture, engineering, and construction, you can ensure all drawings are aligned before submission. This avoids the delays caused by back-and-forth communication that often result in permit rejections [2]. Additionally, using floorplans that have already been approved under Nova Scotia's municipal codes can simplify the process and avoid unnecessary setbacks [5].

Nova Scotia Market Data and Return Projections

To make informed decisions about building or buying in Nova Scotia, it's crucial to understand the rental market and construction costs. Current rents for new multi-unit properties range from $1,500 to $3,000 per unit, with standard 2-bedroom units (about 800 sq. ft.) renting for $1,900 to $2,250 per month [2]. Demand for purpose-built rentals is strongest in Halifax (including Dartmouth and St. Margaret's Bay), Truro, and Kentville, where supply consistently lags behind demand [2]. These figures provide a baseline for evaluating potential returns.

Construction costs in the region vary significantly depending on the building type. According to CMHC's Q1-2025 Atlantic construction data, hard costs range from $223 to $417 per sq. ft. [4]. For a sixplex - one of the more cost-effective layouts - hard construction costs fall between $217,000 and $271,000 per unit, or $263 to $329 per sq. ft. [4]. Fourplexes tend to cost more, ranging from $236,000 to $357,000 per unit, while stacked townhouses come in at $260,000 to $387,000 per unit [4]. These costs exclude land, HST, and soft costs like permits and legal fees, which must also be factored into your financial planning.

Investors typically use a 5% capitalization rate to value multi-unit rental properties in Nova Scotia, basing this on net operating income (NOI) [1]. For example, a six-unit building with an annual NOI of $105,120 would be valued at approximately $2,102,400 using a 5% cap rate. This creates about $400,000 in instant equity upon project completion [1]. Operating expenses for newer buildings are estimated at around 25% of gross annual rent, with a conservative 2% vacancy rate built into the projections [1].

A key challenge for investors is the gap between "market rent" and "economic rent" - the rent needed to achieve a 10% cash-on-cash return [3]. In some areas of Nova Scotia, market rents alone may not fully support traditional development costs. This is where strategies like fixed-price construction contracts or creative financing options can help close the gap [3]. Running detailed projections for both market and economic rents is essential to ensure your project generates the returns you’re targeting, rather than just breaking even.

Timelines are another critical factor. Traditional construction often takes around 18 months, which means carrying costs and no rental income over that period. By comparison, a six-month build could save roughly $144,000 in lost rent, based on market averages [1]. When combined with the ability to refinance at a 5% cap rate and recover HST rebates, building new offers the potential to recover a large portion of your initial capital. This approach not only builds equity but also reduces the amount of capital tied up in the project [1].

How to Choose Between Building and Buying

When deciding whether to build or buy, it all boils down to your available capital, timeline flexibility, and whether you prioritize immediate rental income or long-term equity growth. Building new multi-unit rental properties can generate strong equity gains through forced appreciation, steady cash flow, and potential HST rebates[1]. On the other hand, buying an existing property offers instant rental income but relies on market-rate appreciation over time.

Your risk tolerance plays a big role here. Building comes with its share of challenges - zoning issues, material delays, and coordination headaches. These risks can be minimized with an integrated design-build approach, but traditional construction projects often see cost overruns of around 30%, plus delays that can lead to monthly losses and missed opportunities[2]. If you're looking to avoid these uncertainties, buying an existing property might be a safer bet, though it could come with its own set of problems, like deferred maintenance or tenant disputes. Weighing these risks will help you figure out which path aligns better with your comfort zone.

To make an informed decision, conduct a feasibility analysis by comparing "market rent" to "economic rent" - the rent needed to hit a 10% cash-on-cash return over a ten-year period[3]. In some Nova Scotia markets, if market rents are much lower than economic rents, building might only make sense with creative financing or cost-cutting measures. But if you can secure reasonably priced land and lock in fixed-price construction, you might profit from the difference between the actual build costs and the asset's income-based valuation.

Your long-term goals should ultimately guide your choice. Building is ideal if you're planning to refinance after completion to recover your initial investment and HST rebates. This lets you free up capital while keeping an appreciating asset in your portfolio - a strategy that supports scaling through a "build-refinance-repeat" cycle. But if you're looking for a simpler, more hands-off approach without diving into construction financing and refinancing, buying an existing property offers a direct route to steady rental income.

Conclusion

Deciding whether to build or buy rental properties in Nova Scotia depends on your capital, timeline, and long-term investment goals. Building multi-unit properties can generate substantial equity quickly and provide access to HST rebates[1]. On the other hand, buying existing properties offers immediate rental income but relies more on market appreciation than the equity gains achieved through new development. These trade-offs reflect the financial considerations discussed earlier.

Your comfort with risk is a critical factor. Traditional construction projects often face cost overruns and delays[2]. While an integrated design-build process can reduce these risks, building still requires navigating financing and zoning hurdles. If you'd rather avoid these complexities, purchasing an existing property is a more straightforward option, though it may come with challenges like deferred maintenance and tenant turnover.

A key metric to evaluate is the economic rent - what you'd need to charge for a 10% cash-on-cash return - compared to current market rents. If market rents in your area of Nova Scotia can support this return, building becomes a feasible option[3]. If not, you may need to consider reducing land costs or exploring alternative financing methods to make the project work financially.

For investors with at least $150,000 in accessible equity, the build-refinance-repeat strategy offers a scalable way to grow a portfolio[2]. This method allows you to recover part of your initial investment through refinancing while holding onto a cash-flowing asset that appreciates over time. However, for those looking for a simpler entry into the market, buying existing properties may be more appealing - just remember to account for renovation costs and tenant management. Aligning these considerations with your financial goals will help clarify whether building or buying is the right path for you.

FAQs

How do I estimate the true all-in cost to build a 6-unit rental in Nova Scotia?

If you're planning to build a 6-unit rental in Nova Scotia, you'll need to factor in a range of costs to get an accurate picture of your investment. Construction costs typically fall between $135 and $200 per square foot, depending on the quality of finishes and materials. But that's just the start. You'll also need to account for additional expenses like land acquisition, soft costs (permits, fees, and professional services), and design work.

For a more precise estimate, it's smart to consult local design-build firms or other professionals. They can help you factor in site-specific considerations - like soil conditions or municipal requirements - that can significantly impact your budget.

What financing options can reduce the down payment when building a small multi-unit?

One financing option to consider is the CMHC's MLI Select program, which provides mortgage insurance for properties that are energy-efficient or accessible. With this program, down payments can be as low as 5%. It's tailored for investors looking to develop small multi-unit rentals while aligning with energy efficiency and accessibility standards.

How do I compare market rent vs. economic rent for my target return?

To assess the difference between market rent and economic rent for your desired return, start by comparing the expected rental income to the operating expenses and financing costs. Look at current market rent trends and weigh them against the property's potential income to confirm it aligns with your financial goals. Resources like CMHC's rental feasibility studies and detailed cash flow analyses can provide valuable insights to support your evaluation.